The Major, Minor, and Exotic Pairs

Forex pairs are grouped into categories:

- Major pairs – Include the US dollar and other major economies (e.g., EUR/USD, GBP/USD, USD/JPY). They’re highly liquid and widely traded.

- Minor pairs – Do not include the US dollar but involve other major currencies (e.g., EUR/GBP, AUD/NZD).

- Exotic pairs – Pair a major currency with one from a smaller or emerging economy (e.g., USD/TRY, EUR/SEK). These can be more volatile and less liquid.

What is a “pip”?

A pip (short for percentage in point or price interest point) is the standard unit of measurement for price movement in the forex market. It represents the smallest change in value for most currency pairs.

How it works:

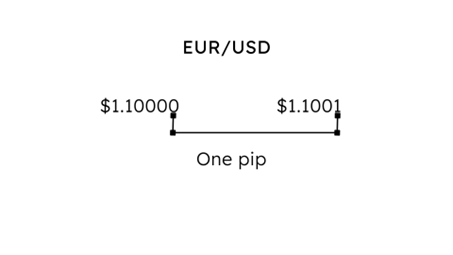

- For most pairs, 1 pip = 0.0001 of the quoted price (the fourth decimal place).

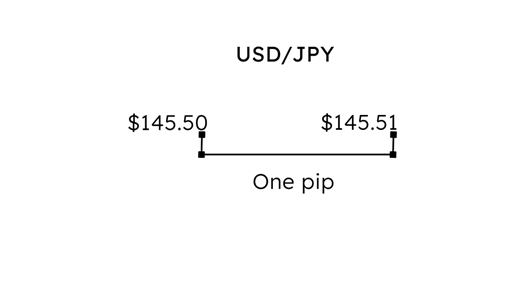

- For pairs involving the Japanese yen, 1 pip = 0.01 (the second decimal place).

Example:

- If EUR/USD moves from 1.1000 to 1.1001, that’s a 1-pip increase.

- If USD/JPY moves from 145.50 to 145.51, that’s also 1 pip.

Why pips matter: Pips are used to calculate both profit/loss and the size of a price move. For example, if you bought EUR/USD and it moved 50 pips in your favor, the profit you make depends on your position size (lot).

What is a Lot?

A lot is the standardized quantity of a currency you trade in forex. It determines how much each pip movement is worth in monetary terms.

Types of lots:

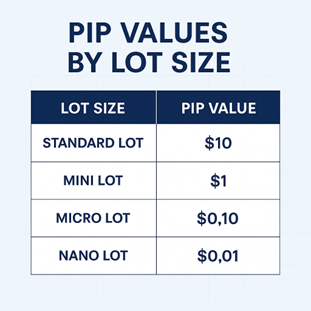

- Standard Lot – 100,000 units of the base currency.

- Mini Lot – 10,000 units of the base currency.

- Micro Lot – 1,000 units of the base currency.

- Nano Lot – 100 units of the base currency (not all brokers offer this).

Example:

- If you trade a standard lot on EUR/USD, each pip is typically worth $10.

- Mini lot: $1 per pip

- Micro lot: $0.10 per pip

How Pips and Lots Work Together

Let’s say you buy 1 standard lot of EUR/USD at 1.1000 and close the trade at 1.1050. That’s a 50-pip gain.

- Standard lot (100,000 units): 50 pips × $10 = $500 profit

- Mini lot (10,000 units): 50 pips × $1 = $50 profit

- Micro lot (1,000 units): 50 pips × $0.10 = $5 profit

What moves the forex markets?

What moves the forex markets?

Currency values are not fixed—they fluctuate constantly based on a complex mix of economic, political, and market forces. Every second, global events, financial data releases, and shifts in investor sentiment can cause exchange rates to rise or fall. Understanding these drivers is essential for traders, as they help explain why markets move and provide clues for predicting future price trends.

Several factors influence the value of currencies, including:

- Economic indicators – GDP growth, inflation rates, and employment data.

- Interest rates – Higher interest rates often attract foreign capital, boosting a currency.

- Political stability – Uncertainty can weaken a currency.

- Market sentiment – Traders’ perceptions and risk appetite can drive prices.