Why Study Advanced Patterns?

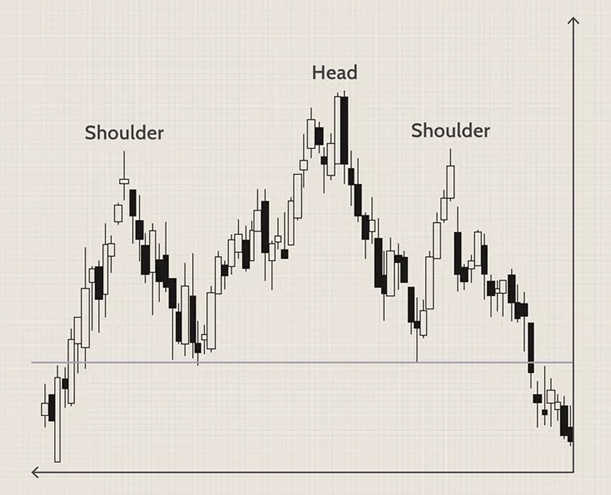

Head and Shoulders Pattern:

🔹 Example:

A stock forms three peaks, with the middle peak (head) higher than the two shoulders.

Credit: Image by Sabrina Jiang © Investopedia 2020

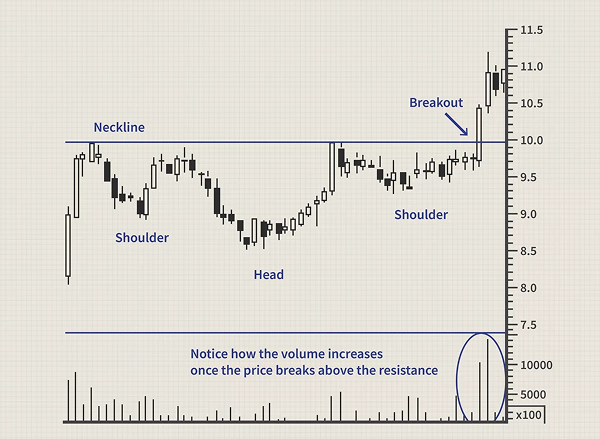

Inverse Head and Shoulders:

🔹 Example:

After a downtrend, stock creates an inverse pattern, suggesting an upward reversal.

Credit: Image by Sabrina Jiang © Investopedia 2020

Double and Triple Tops/Bottoms:

🔹 Example:

Double top at resistance, indicating bearish reversal.

Triangles (Ascending, Descending, Symmetrical):

🔹 Example:

Ascending triangle in an uptrend suggests likely breakout upward.

Flags and Pennants:

🔹 Example:

Bullish flag pattern during an uptrend indicates potential continuation higher.

Cup and Handle:

🔹 Example:

Price forms a rounded bottom (cup) followed by a small downward drift (handle), then resumes upward.

Wedges (Rising and Falling):

🔹 Example:

Rising wedge in an uptrend typically forecasts a bearish reversal.

Importance of Volume:

Interpreting Volume in Patterns:

🔹 Example:

Significant volume increase during a breakout of a triangle pattern indicates a stronger move.

Entry Strategies:

Exit Strategies:

Risk Management:

Trade Example 1: Head and Shoulders

Trade Example 2: Bullish Flag

Mistakes:

Solutions:

You are now equipped with advanced knowledge of chart patterns and strategic insights for more profitable trading. Sky Links Capital offers sophisticated tools, ongoing education, and expert support to further refine your trading skills.

Enhance your trading results today—partner with Sky Links Capital for continued trading success!

Disclaimer: The information and tools provided by Sky Links Capital are strictly for educational and informational purposes only. They do not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Users should make independent decisions based on their own research and, where appropriate, seek professional advice.