Fundamental analysis involves examining a company’s financial health, economic indicators, and market conditions to determine its intrinsic value.

Core Principles:

Essential financial documents:

Important ratios for analyzing financial health:

🔹 Example:

A low P/E might indicate an undervalued company, while a high ROE signifies efficient management.

Assess leadership quality:

Understand the broader context:

🔹 Example:

A technology firm operating in a rapidly growing industry might have promising future prospects.

Macro-economic factors influencing investments:

Methods for determining intrinsic value:

🔹 Example:

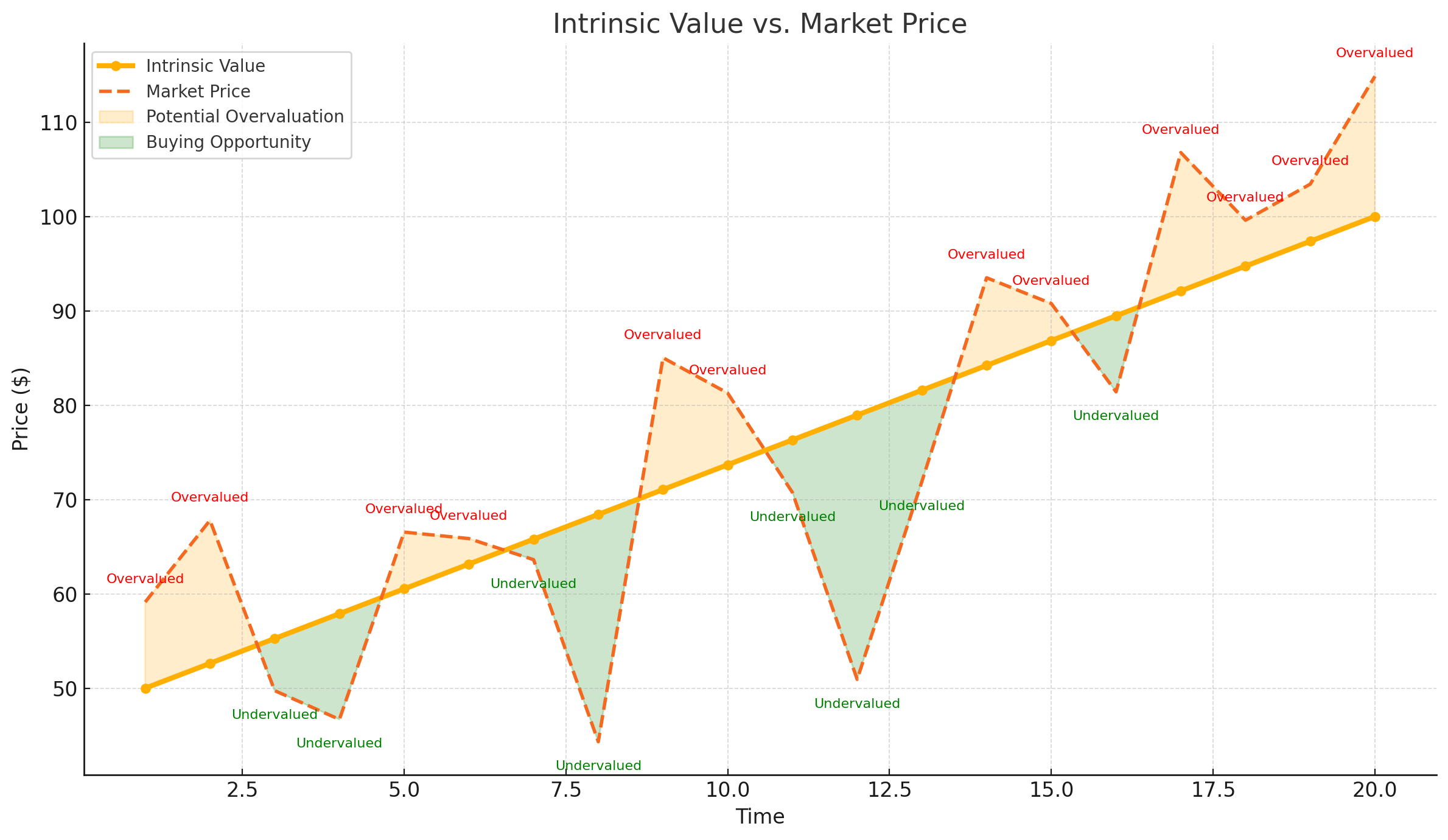

DCF analysis showing a stock’s intrinsic value significantly higher than market price suggests a potential buying opportunity.

Steps to select investments using fundamental analysis:

🔹 Example:

Choose companies with solid financials, reputable management, and positive industry trends.

Pitfalls in fundamental analysis:

You are now equipped with:

Sky Links Capital offers professional tools and expert guidance to support your fundamental analysis journey.

Take control today—partner with Sky Links Capital and become a confident, informed investor!

Disclaimer: The information and tools provided by Sky Links Capital are strictly for educational and informational purposes only. They do not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Users should make independent decisions based on their own research and, where appropriate, seek professional advice.