What is Swing Trading?

Benefits of Swing Trading

Key Concepts in Swing Trading

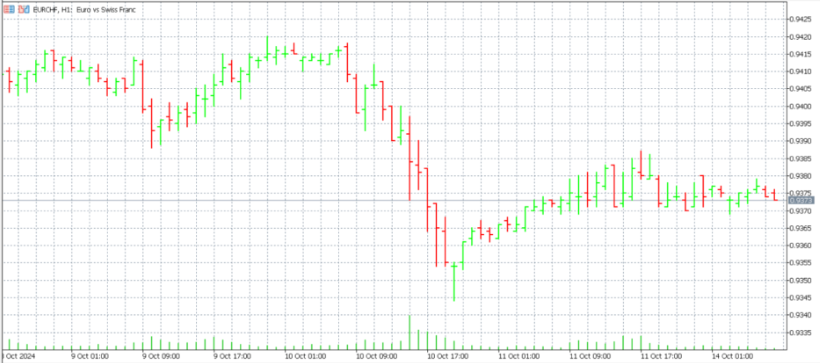

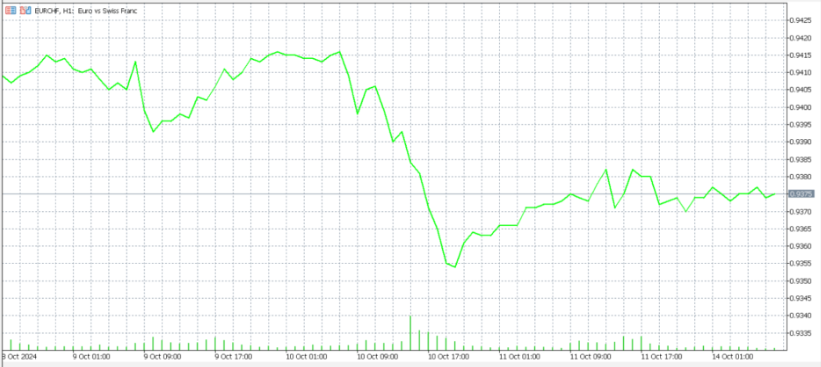

Chart Types

Technical Indicators

Importance of Technical Analysis

Strategy 1: Moving Average Crossover

Example:

🔹 Entry: Buy when the 20-day MA crosses above the 50-day MA.

🔹 Exit: Sell when the 20-day MA crosses back below the 50-day MA.

Strategy 2: RSI Divergence

Example:

🔹 Entry: Bullish divergence when price makes lower lows, but RSI makes higher lows.

🔹 Exit: Target nearest resistance or after RSI peaks above 70.

Strategy 3: Support and Resistance Trading

Example:

🔹 Entry: Buy near support after confirmation (bullish candlestick pattern).

🔹 Exit: Sell near resistance level or set stop-loss below recent support.

Trend Analysis

Chart Patterns

Example: Cup and Handle Pattern

🔹 Enter after breakout from handle formation, set stop-loss below handle bottom, exit at measured target.

Importance of Risk Management

Risk Management Techniques

Example:

🔹 If entry price is $100, set stop-loss at $98 (risk $2 per share). Adjust shares traded to stay within risk tolerance.

Trade Example 1: RSI Divergence

Trade Example 2: Moving Average Crossover

Typical Mistakes

Solutions

Importance of Emotional Control

Practical Tips for Emotional Discipline

Congratulations! You’ve now acquired actionable swing trading strategies, practical insights, and essential techniques designed to sharpen your swing trading skills.

Remember, consistency, discipline, and continuous learning form the foundation for long-term trading success.

Sky Links Capital offers advanced resources, professional insights, and continuous support to enhance your trading skills further.

Take your next step today—partner with Sky Links Capital to begin your journey towards trading success!

Disclaimer: The information and tools provided by Sky Links Capital are strictly for educational and informational purposes only. They do not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Users should make independent decisions based on their own research and, where appropriate, seek professional advice.